Menu

Completely confidential. Plagiarism- free. Delivered

on time or your money back!

for rush papers due in 24 hrs or less! Flexible turnaround times for longer deadlines.

with B.A./M.A. degrees and profound experience in academic writing.

Authentic papers written from scratch per your instructions, free plagiarism report.

over the writing process, direct communication with your writer and order status tracking in real time.

Unlimited revisions during the 14 days guarantee period, personal approach to every order!

starting from $12.95/page. Exclusive discounts for returning customers!

When life becomes a series of never-ending appointments, “to-do” lists, deadlines and overall exhaustion of your body and mind, it’s time to take some weight off your shoulders and get a professional research paper help from trusted paper writing service that will relieve you from the pressure of approaching academic deadlines!

SOLID EXPERIENCE

For over 10 years we’ve been providing trustworthy and reliable research paper writing service to students from all corners of the world. Our experienced and highly educated research paper writers are fully versed to deliver authentic and plagiarism-free custom papers on any topic! In fact, our dedicated team has now written over 5,700 customized term papers, research papers and essays for History, Sociology, Political Science, Marketing, Management and many other disciplines of academic curriculum.

HIGHEST ACADEMIC WRITING STANDARDS

We guarantee the delivery of truly original research papers and essays to the highest standards of academic writing and promise to provide you with the best research paper writing service, so that you could relax and have a good night’s sleep, even if your paper is due tomorrow

Strong educational background and years of experience in academic writing make our team stand against the crowd of amateurs. Besides, we operate 24×7, so you can always rely on us to get your custom paper written in 24 hrs or less. However, do not deceive yourself believing that you can get a high quality service while buying cheap research papers!

FAIR PRICING POLICY

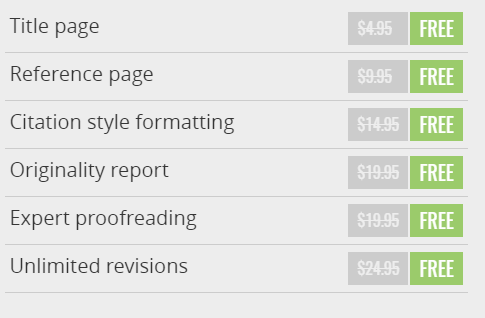

Our professional paper writers expect a fair reward for their job and we must keep abreast of market prices in order to retain the top academic experts in the field. Thus, to maintain a healthy balance between the quality and cost of our paper writing service and make it more affordable to our clients, we offer a range of time-sensitive delivery options and base our pricing on a deadline and academic level of the requested assignment.

100% SATISFACTION GUARANTEE

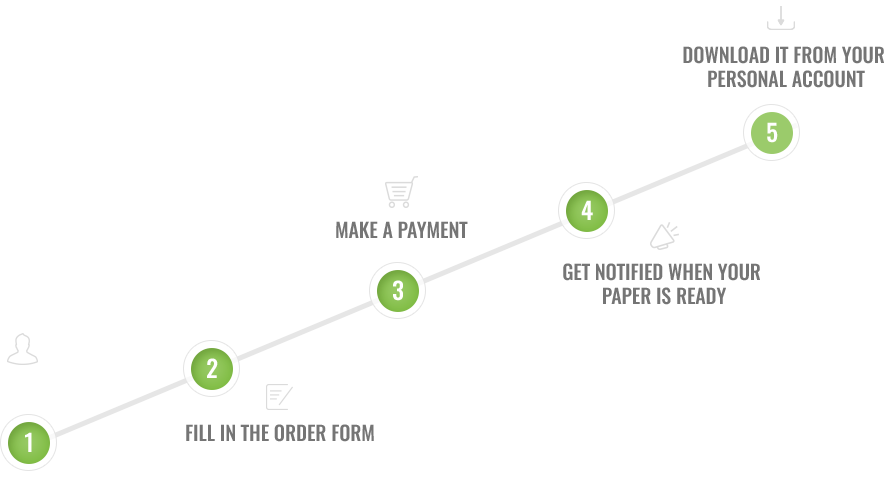

And if for any reason you are not satisfied with the custom research paper you received, or your instructions have not been followed precisely and you would to have your draft revised – you are eligible for the unlimited number of revisions during the first 14 days since your order delivered. We’ll work with until you are completely satisfied!

How To Buy Research Papers Without Risk

Online Research Paper Writers For Hire

Research Papers For Sale: Up to 15% OFF!

Best Research Paper Writing Service Online

Privacy Policy • Terms of Service • Refund Policy

© 2003 – 2023 Getacademicpapers.com All Rights Reserved.